Nvidia (NVDA) delivered a knockout punch to Wall Street’s expectations last week, reporting a staggering 69% year-over-year sales surge for its latest quarter, cementing its iron grip on the artificial intelligence (AI) chip market. The Santa Clara-based juggernaut’s results sent shockwaves through the tech sector, propelling AI-related stocks and pushing its own market capitalization to a towering $2.9 trillion. However, a looming $8 billion sales hit from U.S. export restrictions on China introduced a note of caution, underscoring the geopolitical risks facing the AI boom.

Nvidia’s earnings, released after market close on May 28, showcased its dominance in supplying chips for generative AI applications. Revenue for the fiscal quarter reached $35.1 billion, up 69% from the prior year, driven by unrelenting demand for its H100 and Blackwell GPUs from cloud giants like Amazon, Microsoft, and Google. Data center revenue, Nvidia’s largest segment, soared 112%, while gaming and automotive segments grew 15% and 18%, respectively. Earnings per share hit $0.78, topping analyst estimates of $0.71.

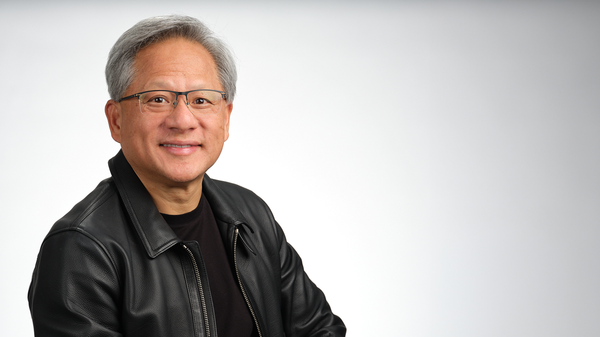

“Nvidia continues to redefine the tech landscape,” said Jensen Huang, Nvidia’s CEO, in a call with analysts. “AI is the new industrial revolution, and we’re just getting started.” The company’s guidance for the next quarter—projecting $32.5 billion in revenue—further fueled optimism, though it fell slightly below lofty Wall Street expectations of $33 billion.

The earnings report lit a fire under AI-related stocks, with Palantir Technologies (PLTR) jumping 8.13% and Zscaler (ZS) soaring 12.18% for the week. Other beneficiaries included Broadcom (AVGO, +3.7%) and Marvell Technology (MRVL, +5.2%), as investors bet on the ripple effect of Nvidia’s AI infrastructure dominance. The broader technology sector gained 1.98%, helping lift the Nasdaq 100 by 2.3% and contributing to the S&P 500’s 2.1% weekly rise.

“Nvidia’s results are a barometer for the AI economy,” said Wedbush Securities analyst Dan Ives. “This isn’t just about chips—it’s about the entire ecosystem, from software to cybersecurity, riding Nvidia’s coattails.” The company’s success has validated the massive capital expenditures by hyperscalers, with Amazon alone planning $75 billion in AI infrastructure investments for 2025.

Despite the euphoria, Nvidia flagged a significant headwind: U.S. export controls tightened in early 2025 will slash $8 billion in sales to China, a key market accounting for 15% of its revenue. The restrictions, aimed at curbing China’s access to advanced AI technology, target Nvidia’s high-end GPUs and are expected to dent growth in 2026. “We’re navigating a complex geopolitical landscape,” Huang acknowledged, noting the company is accelerating development of China-compliant chips.

The warning rattled investors, briefly pushing Nvidia’s stock down 2% in after-hours trading before it recovered to close the week up 4.6%. The broader market also felt the ripple, with some analysts warning that trade tensions could cap AI-driven gains. “Nvidia’s exposure to China is a vulnerability,” said Morgan Stanley’s Joseph Moore. “The market is pricing in resilience, but this is a wildcard.”

While Nvidia thrives, rival Intel (INTC) faced a grim week, announcing a 15% workforce reduction—approximately 15,000 jobs—as part of a $10 billion cost-cutting plan for 2025. Intel’s stock slid 3.2%, reflecting ongoing challenges in its foundry business and slower progress in AI chip development. CEO Pat Gelsinger cited “structural inefficiencies” and a need to “right-size” operations to compete with Nvidia and TSMC. The contrast underscores Nvidia’s unique position in the AI-driven tech hierarchy.

Nvidia’s performance has reignited debate over whether the AI boom is sustainable or approaching bubble territory. With a forward P/E ratio of 45, Nvidia’s valuation dwarfs competitors, yet its growth trajectory continues to defy skeptics. Investors are now eyeing upcoming earnings from Broadcom and Marvell, which could further signal the health of the AI supply chain.

Geopolitical risks remain a wildcard, with U.S.-China trade tensions and potential tariff escalations looming. “Nvidia’s ability to innovate around export curbs will be critical,” said Goldman Sachs analyst Toshiya Hari. For now, the AI kingpin’s earnings have injected fresh momentum into tech, but the road ahead may test the sector’s resilience.