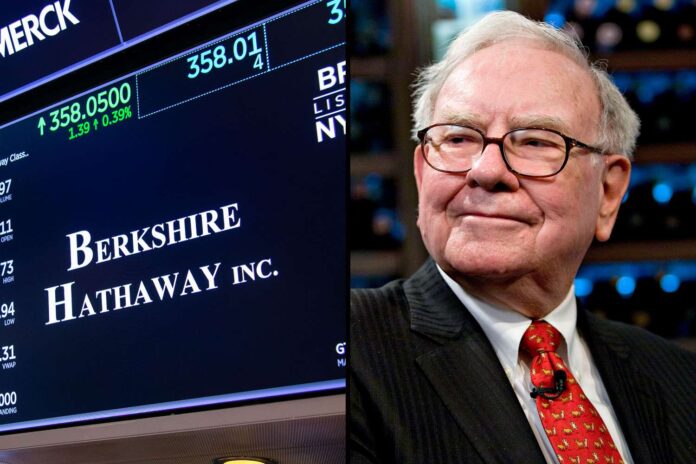

The news hit like a quiet thunderclap: Warren Buffett, the 94-year-old wizard of wealth, will step down as CEO of Berkshire Hathaway by the end of 2025. For six decades, he’s been the beating heart of American capitalism, turning a creaky textile mill into a $1 trillion juggernaut. With a fortune north of $150 billion, a Cherry Coke in hand, and a grin that disarms the sharpest critics, Buffett has lived a life that’s equal parts legend and lesson. As he readies to pass the torch to Greg Abel, the world pauses to salute a man who made billions by betting on the long game—and gave most of it away.

Picture Omaha, 1930. A boy with a head for numbers and a hustle to match is born into a modest home. Young Warren, son of a stockbroker-turned-congressman, is hawking newspapers and chewing gum by age six, dreaming bigger than his Nebraska roots. By 11, he’s dipping his toes in the stock market, buying shares of a gas company and learning the sting of a bad bet. At 15, he’s got $6,000 in his pocket from pinball machines and paper routes, enough to snap up a farm. Failure? Sure, he’s tasted it—like the gas station he sank $2,000 into at 21, a flop that taught him to trust his gut.

Columbia Business School was his crucible, where he soaked up the gospel of value investing from Benjamin Graham. Buy great companies cheap, hold them forever—that was the mantra. Back in Omaha, he launched a partnership in 1956 with $105,000, mostly from folks who believed in the skinny 25-year-old with a knack for picking winners. By 30, he was a millionaire. By 1965, he’d taken the wheel of Berkshire Hathaway, a fading textile outfit he’d mold into a colossus.

Berkshire became Buffett’s canvas. He painted with bold strokes: Geico, Coca-Cola, American Express, and later, a massive bite of Apple. His formula? Find businesses with unshakable moats—brands or models competitors couldn’t touch—and buy them at a discount. From 1965 to 2024, Berkshire’s stock grew at nearly 20% a year, lapping the S&P 500 like a sprinter dusting a jogger. A hundred bucks invested with Buffett in ’64 would be $6 million today. He didn’t just beat the market; he rewrote its rules.

Mistakes? Plenty. He passed on Google, fumbled IBM, and once called his jet purchase “indefensible” while grinning at the irony. But Buffett’s magic was his clarity—admit the miss, move on, and never stray from the fundamentals. His annual letters to shareholders, laced with wit and wisdom, were like sermons from a capitalist preacher. He ran Berkshire with a light touch, letting managers steer their ships while he played the long game from Omaha, often munching a burger from McDonald’s.

Then there’s the giving. In 2006, he shocked the world, pledging 99% of his wealth to charity, with the Gates Foundation as the main beneficiary. Over $60 billion has flowed out since, funding everything from global health to education. He coaxed other tycoons to join the Giving Pledge, proving wealth could be a tool, not a trophy. All this from a guy who still lives in the $31,500 house he bought in 1958, drives a beat-up Cadillac, and once paid for Bill Gates’ lunch with McDonald’s coupons.

Buffett’s life wasn’t all balance sheets. He strummed the ukulele, played bridge with Gates, and kept his humor sharp. His marriage to Susan Thompson, and later to Astrid Menks, was as unconventional as his investing—yet it worked, grounded by loyalty. Cancer tried to slow him in 2012, but he brushed it off, back at his desk in no time. Every year, thousands trekked to Omaha for Berkshire’s shareholder meeting, a festival of capitalism where Buffett held court, dispensing quips and truths.

Now, as he prepares to step back, Buffett’s betting on Abel to carry the flame. He’ll likely stay on as chairman, his fingerprints still on the empire he built. At the 2025 meeting, he stood before the crowd, eyes bright, and said, “America’s best days are ahead.” It wasn’t just talk—Berkshire’s moves, like trimming Bank of America and buying into Constellation Brands, show he’s still playing chess while others play checkers.

Warren Buffett didn’t just build wealth; he built a philosophy. Live simply. Invest patiently. Give generously. As the Oracle of Omaha takes his final bow, his story reminds us that the greatest fortunes aren’t measured in dollars, but in impact. And in that, he’s richer than anyone.

By: Montana Newsroom staff