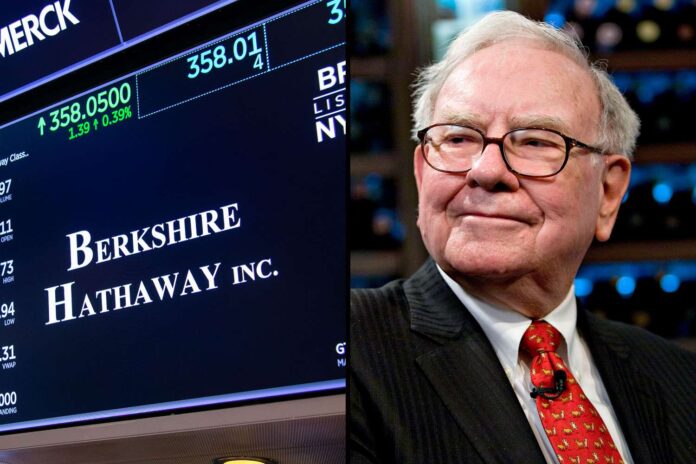

For nearly six decades, Warren Buffett, the legendary investor and CEO of Berkshire Hathaway, has penned his annual letters to shareholders. These letters, filled with a combination of wit, wisdom, and a rare ability to translate complex financial concepts into accessible language, have become a cornerstone of the investing world. They have offered insight not only into Buffett’s investment philosophy but also into the principles that have guided his approach to business and life. However, the 2024 edition of his letter carries a profound sense of finality, as it may well be the last time Buffett addresses shareholders in his capacity as CEO. At 94 years old, Buffett, widely known as the “Oracle of Omaha,” is preparing to step aside and pass the baton to the next generation of leadership at Berkshire Hathaway.

The 2024 letter, like so many of its predecessors, is candid and self-reflective. Buffett looks back on a career that spans nearly seven decades, acknowledging both triumphs and mistakes with equal grace. He does not shy away from discussing his missteps—mistakes in capital allocation, in certain personnel decisions, and in investments that didn’t pan out as expected. Buffett’s humility and ability to take responsibility for both his successes and failures have been key aspects of his leadership style, earning him the respect of his peers and the admiration of investors worldwide.

Yet, while the letter is filled with personal reflections, it also marks a pivotal moment in the history of Berkshire Hathaway. With the looming transition of leadership, Buffett’s final letter carries a sense of quiet confidence in his successor, Greg Abel. Abel, the current vice chairman for non-insurance businesses at Berkshire, is widely regarded as the man best suited to take over the reins of the company. Buffett expresses full confidence in Abel’s ability to uphold Berkshire’s unique culture and its long-term investment philosophy. It is clear that, for Buffett, this succession plan represents not just a passing of the baton, but the preservation of a legacy—a legacy built on a commitment to value investing, a culture of trust, and a long-term approach to business that has served Berkshire well for decades.

Buffett’s letter also serves as a reminder of the remarkable scale of Berkshire Hathaway’s empire. Under Buffett’s stewardship, the company has grown into a diversified conglomerate with significant holdings in industries ranging from insurance to railroads to utilities. While other companies may have chased short-term profits or prioritized dividends to shareholders, Buffett has remained steadfast in his commitment to reinvest Berkshire’s profits into new opportunities and businesses that can create long-term value. This approach has allowed the company to continually grow its intrinsic value, a key metric Buffett has often emphasized as the true measure of a company’s success.

Perhaps the most eye-catching statistic in this year’s letter, however, is the staggering amount of corporate taxes that Berkshire Hathaway paid in 2024: $26.8 billion. This record-breaking figure is not only a testament to the sheer size and profitability of the company, but it also underscores Buffett’s belief in paying taxes as a civic duty. In a time when some of the world’s largest corporations have faced scrutiny for their tax practices, Buffett has consistently argued that companies should pay their fair share. Berkshire’s tax bill is a reflection of Buffett’s philosophy that businesses should contribute to the broader society that enables their success, further cementing his reputation as a principled businessman who values both profit and purpose.

As Buffett turns over the reins to Greg Abel, the question arises: What will the future hold for Berkshire Hathaway in a post-Buffett world? The answer, while uncertain in many ways, is grounded in the enduring principles that Buffett has instilled in the company over the years. Berkshire’s commitment to sound business practices, its focus on long-term value creation, and its decentralized management structure are all aspects of Buffett’s legacy that will likely continue to guide the company for years to come.

The future of Berkshire Hathaway, and indeed, the future of American capitalism, is in many ways intertwined with the story of Warren Buffett. For nearly six decades, he has been a guiding force, an investor with a rare combination of wisdom, humility, and an uncanny ability to read the market. As he steps down from his role as CEO, his influence will undoubtedly remain, and the principles he championed will continue to shape the way businesses operate in the 21st century.

The Oracle of Omaha’s legacy is a testament to the power of patience, discipline, and a long-term perspective in investing and business. His imprint on American capitalism is indelible, and while this may be his final letter to Berkshire Hathaway shareholders, his voice, his lessons, and his philosophy will continue to echo through the company and the broader world of business for generations to come. The story of Warren Buffett is far from over—it is, in fact, just beginning a new chapter, one where the torch is passed, but the guiding principles remain unchanged.

By: Montana Newsroom staff