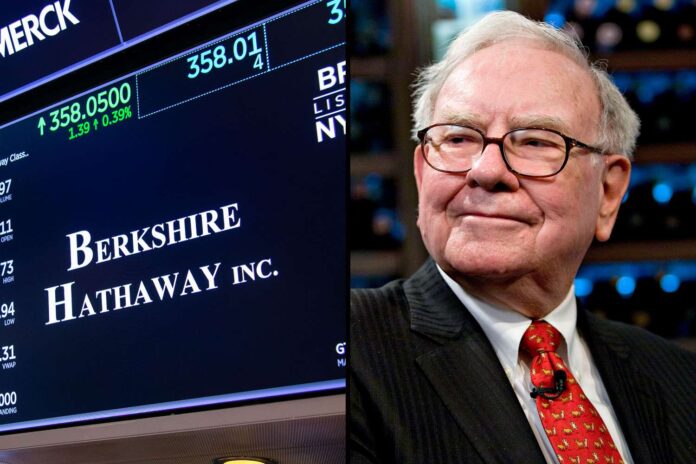

While Wall Street wavered in 2024, Warren Buffett and Berkshire Hathaway leaned into one of their oldest tricks: holding onto an enormous cash pile and waiting for the right opportunities. The strategy paid off handsomely.

Berkshire reported $47.4 billion in operating earnings for 2024—an increase fueled in part by rising Treasury yields. With over $189 billion in cash and short-term investments, the conglomerate capitalized on higher interest rates, raking in $13.7 billion in investment income alone.

Insurance, always the bedrock of Berkshire’s empire, saw a major turnaround. GEICO, under Todd Combs’ leadership, dramatically improved underwriting results, while the broader property-casualty business thrived despite climate-driven catastrophes. Meanwhile, Berkshire’s railroad and utility businesses, though steady, left room for improvement.

Buffett also reaffirmed his commitment to equities, particularly in American and Japanese markets. While the firm’s stake in Apple remains its crown jewel, Berkshire continues to deepen its relationship with Japan’s five major trading houses, a strategy Buffett says will remain for “many decades.”

With Greg Abel preparing to take the reins, Berkshire is armed with record cash reserves, an ironclad insurance business, and a long-term vision that remains unchanged. The Oracle’s discipline, it seems, will outlast the man himself.

By: Montana Newsroom staff